🏠 The Evolution of California’s Residential Real Estate Market: 1970s to Today

California has always held a special allure for homebuyers: a place where sun-kissed coastlines meet opportunity, innovation, and prosperity. But behind the golden image lies a dynamic, sometimes volatile housing market shaped by shifting interest rates, demographic trends, economic cycles, and evolving loan products. Let’s take a journey through the decades and explore how California’s residential real estate market has transformed from the 1970s to today.

🌼 1970s: Booming Growth and the Beginning of Inflation

The 1970s were marked by strong population growth, suburban expansion, and the rise of the middle-class homeowner. Home prices were modest by today’s standards—averaging around $25,000 in the early ‘70s—but the seeds of change were already being sown.

Key Factors:

-

Interest Rates: Started the decade around 7%, but inflation pushed them up sharply. By 1979, mortgage rates had reached double digits.

-

Loan Types: Fixed-rate 30-year mortgages dominated. Adjustable-rate mortgages (ARMs) were not yet common.

-

Buyer Profiles: Predominantly nuclear families, often first-time buyers with single-income households.

-

Demographics: California’s population surged due to the baby boom and migration from other states.

💥 1980s: High Interest Rates and Creative Financing

This decade saw some of the highest interest rates in U.S. history. In 1981, 30-year mortgage rates peaked at over 18%. The result? Home prices grew slowly, and creative financing became the norm.

Key Factors:

-

Interest Rates: Averaged 12–14% during much of the decade. Made borrowing costly and limited affordability.

-

Loan Types: ARMs became popular, along with seller financing, assumable loans, and balloon payments.

-

Buyer Profiles: More dual-income households. Homeownership remained a goal, but affordability strained middle-class buyers.

-

Demographics: California attracted tech and aerospace workers, especially in areas like Silicon Valley and Orange County.

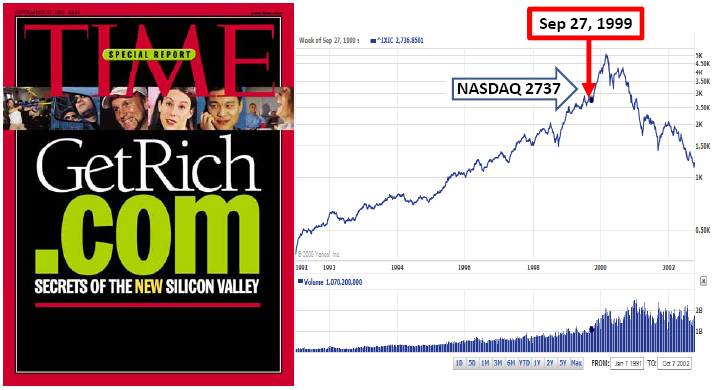

📈 1990s: The Tech Boom and a Recession

The early 1990s started with a recession, job losses in defense and aerospace, and declining home prices in Southern California. But by the mid-to-late ‘90s, the tech boom sparked a housing rebound.

Key Factors:

-

Interest Rates: Fell to more manageable levels—around 7–9%—spurring new homebuyer activity.

-

Loan Types: Fixed-rate loans made a comeback, but ARMs remained popular in high-cost markets like San Francisco and LA.

-

Buyer Profiles: Tech professionals and dual-income families drove demand in urban centers.

-

Demographics: Increasing diversity with more immigrants entering the housing market, especially in Los Angeles and the Bay Area.

🧨 2000s: Bubble, Bust, and the Mortgage Crisis

The early 2000s saw skyrocketing home prices, especially in California, fueled by low interest rates, easy credit, and speculative buying. By mid-decade, prices were unsustainable—and the 2008 financial crisis brought it all crashing down.

Key Factors:

-

Interest Rates: Historically low, with 30-year rates around 5–6%.

-

Loan Types: Subprime loans, interest-only loans, negative amortization, and stated-income (“liar”) loans flooded the market.

-

Buyer Profiles: Speculators, first-time buyers with little down, and investors seeking rapid appreciation.

-

Demographics: Homeownership extended to more diverse communities, but many were hit hardest in the crash.

🛠 2010s: Recovery, Regulation, and Urban Renaissance

After the crash, the market slowly recovered. Stricter lending standards, demographic shifts, and tech industry growth reshaped California housing.

Key Factors:

-

Interest Rates: Remained historically low—often in the 3–4% range.

-

Loan Types: Fully documented fixed-rate mortgages became the norm. FHA loans helped first-time buyers.

-

Buyer Profiles: Millennials entered the market, often later and with more student debt. Investors also snapped up foreclosures early in the decade.

-

Demographics: Increased demand for urban living, walkability, and access to public transit.

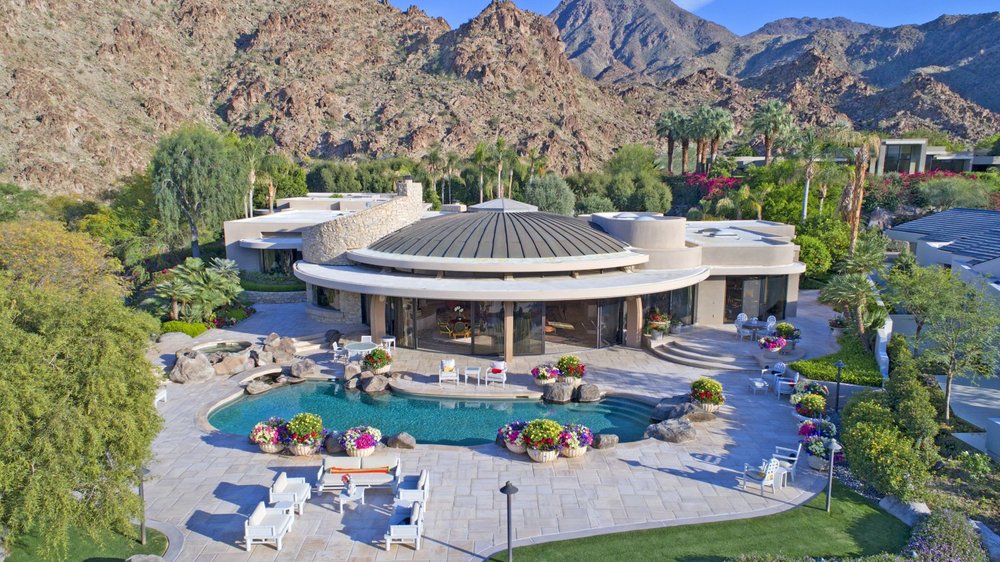

🏡 2020s: Pandemic Boom to Correction

COVID-19 dramatically shifted the real estate landscape. Remote work, low interest rates, and limited inventory caused a buying frenzy in 2020–2021, especially in suburban and resort markets. By 2022–2023, rising rates cooled the market.

Key Factors:

-

Interest Rates: Dropped to near 2.5% during the pandemic, but surged past 7% by 2023.

-

Loan Types: Fixed-rate loans remained dominant, but affordability concerns reignited interest in ARMs.

-

Buyer Profiles: Remote workers, Gen Z entering the market, and multigenerational households became more common.

-

Demographics: Migration patterns shifted—some Californians left for lower-cost states, while others moved inland or to vacation-home markets like the Coachella Valley or Lake Tahoe.

🔮 Looking Ahead: 2025 and Beyond

As of 2025, California’s housing market continues to evolve. Affordability remains a challenge, especially in coastal metros. Demand is high, but inventory is constrained by high construction costs, limited land, and owners reluctant to sell due to “golden handcuff” low mortgage rates.

Trends to Watch:

-

Interest Rates: Gradual stabilization expected, possibly hovering between 5–6% in the near term.

-

Loan Innovation: More flexible loan products may return, with a stronger focus on risk management.

-

Buyer Demographics: Gen Z and Millennials will drive the next wave of demand, especially for smaller, more sustainable homes.

-

Technology: Virtual tours, blockchain-based transactions, and AI-powered home searches are becoming standard tools.

-

Legislation: Zoning reform and incentives for new construction may help address the housing shortage—if policies can keep up.

💬 Final Thoughts

From the oil shocks of the 1970s to the tech boom, subprime crisis, and pandemic-driven price spikes, California’s housing market has been anything but static. Buyers, sellers, and investors who understand the state’s historical cycles—and the forces shaping them—are better equipped to make smart, strategic decisions.

If you’re looking to navigate California’s ever-changing real estate landscape, Team Delaney is here to help. With over 50 years of combined experience, we’re more than ready to help you write your own chapter in California real estate history.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link